China Marketing Insights Monthly Newsletter [August 2021]

![China Marketing Insights Monthly Newsletter [August 2021]](https://cdn.octoplusmedia.com/wp-content/uploads/2022/09/China-Marketing-Insights-Monthly-Newsletter-August-2021-1024x524.png)

Welcome to our August Newsletter.

China tech crackdown is in full swing. We start our issue with the latest round of anti-monopoly fines meted out to some of the biggest tech companies. This is the first of series of articles we will focus on to understand the changes to regulation and how they might impact marketing & advertising. Some of the laws are purposely vague and difficult to accurately interpret – we will do our best to analyze – stay tuned.

In this issue, we look at new marketing idea – mini-program for luxury brands on JD.com. While the Olympics has just ended, there are lot more sporting events on the horizon, including winter Olympics in less than 6 month – read out sports marketing trend. As international tourism starts to look optimistic, we look at various ways the tourism industry can make use of WeChat mini-program marketing.

We wrap up this newsletter with App of the month – MaFengWo – the definitive long-form content aggregated for travel enthusiasts, we explore various content and advertising strategies using this app.

From all of us at OctoPlus Media – Stay safe & take care.

Sincerely,

Mia C. Chen

CEO & Co-Founder of OctoPlus Media

JD.COM MINI-PROGRAM

JD Mini Program platform was officially released on April 22, dedicated to bringing new services and new experiences to consumers.

The mini-program will support self-operated stock and automatic activation of POP merchants, new types of non-e-commerce businesses to participate in the mini-program ecosystem. Merchants who join the JD mini-program open platform can use the complete marketing, transaction, payment, membership, and logistics capabilities of the JD platform to construct their own special service scenarios more conveniently. Assist brands to achieve upgrades in ecological scenarios and quickly provide users with a one-stop service experience.

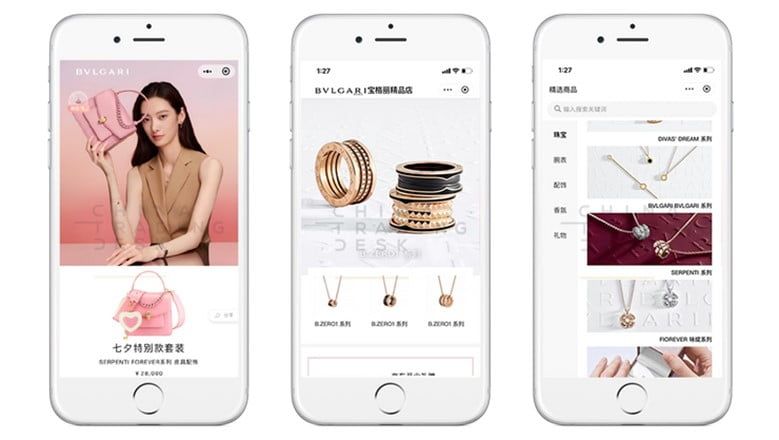

Recently, JD Luxury and Bulgari reached cooperation in the form of JD Mini Programs. Now, users can search for “Bulgari” through the JD APP and go directly to the brand’s official mini-program boutique to purchase BVLGARI products such as jewellery, watches, bags and accessories.

Brands no longer need to embed in the form of WeChat applets or official websites, but directly embed them in the form of JD applets. When the user searches for the “Bulgari” keyword in the JD APP, the Bulgari JD applet pops up directly, and the user no longer needs to authorize the WeChat account. The advantage is to convert public domain traffic into private domain traffic in the form of mini-programs and firmly control user data in their own hands, rather than handing it over to third-party e-commerce platforms.

With this introduction of mini-program and onboarding luxury brands, more such brands are expected to join the initiative very soon.

To learn more about mini-programs across multiple platforms talk to us.

SPORTS MARKETING TRENDS DURING TOKYO OLYMPICS

As the Covid-19 pandemic ravaged multiple countries in 2020, most major sporting events slated for 2020 were postponed. 2021 will be ushered in a “sports year” with multiple international & domestic sporting calendar events. For the first time in history, 2 Olympics events will be held within 6 months of each other, superimpose this with European Cup, EPL, America’s Cup, World Championship, National Games, etc. This year will be a feast for sports fans!

Chinese brands favour sports events

Since the first appearance of a Chinese brand in the sponsorship of the European Cup in 2016, in just five years, the Chinese brands have been promoted to top sponsorship. Of the 12 top sponsor seats in this year’s European Cup, Chinese brands have already accounted for four (Alipay, TikTok, Hisense, and Vivo).

Nielsen’s “2021 Global Sports Marketing Trends” report also pointed out that since the 2008 Beijing Olympics, more and more Chinese companies have adopted sports sponsorship as one of the ways to support their brand growth. According to some reports, China Brands will account for one-third of the total growth in the global sponsorship market.

Which brands particularly like sports marketing?

In addition to sports brands, dairy companies are another strong old player. The two giants, Yili and Mengniu, have participated in sports events for a long time, and their participation is extremely high. Yili has become a dairy product sponsor many times. For example, in the 2008 Beijing Olympics, in the 2022 Beijing Winter Olympics, and the Winter Paralympics, it is the only official dairy product partner. At the same time, Yili has officially announced that it has become the official partner of the AFC in recent days.

In addition to dairy companies, the beauty company – Perfect Diary also participated in becoming the official partner of the Chinese gymnastics team. In addition, this year YTO Express also officially announced that it will become the official logistics service sponsor of the 2022 Hangzhou Asian Games. This is the first time that a Chinese express company has cooperated in a comprehensive international event.

Rise of E-sports sponsorship

Since the e-sports project was approved as an official event in the Asian Games and other events, Chinese brands have begun to pay more attention to the e-sports event. Brands in multiple fields, such as smart hardware, daily necessities, beverages, automobiles, etc., are taking advantage of e-sports marketing.

For example, in the 2021 KPL King of Glory Spring Professional League, in addition to the placement of a variety of live broadcast and accompaniment products from Tencent, the number of ads in the commentary during the game has increased significantly, and even FMVP and other awards have introduced the advertising co-branding of Vivo smartphone IQOO.

Different from traditional sports events, e-sports events can embed the characteristics of diverse scenes, higher matching, and diverse marketing purposes, and can meet the marketing demands of multiple brands. Over time, e-sports is bound to become the main concern of brand owners.

Talk to us to understand more about the opportunity to advertise to sports fans on dedicated sports & fitness apps.

TOURISM MINI-PROGRAM MARKETING

With the improvement of the quality of life and the upgrading of consumption, China has become the world’s largest source of outbound tourists. For Chinese consumers, smartphones are almost an indispensable tool in daily life, and they are frequently used during travel. This also shows that the development of the tourism industry has entered a new stage, which is to use digital methods to provide and promote a wide range of tourism products to bring consumers a richer, personalized and differentiated experience.

Among the many digital tools, the WeChat Mini Program has demonstrated its advantages as a lightweight tool. The WeChat Mini Program is an application in the WeChat APP and does not require additional downloads. More than 230 million WeChat daily active users can easily open and use small programs. The advantage of the applet is that there are many entrances for the applet, which is convenient for users to use and can use WeChat authorization to obtain user data in the WeChat backend. As a lightweight tool, the WeChat applet can be very convenient to design functions suitable for different scenarios and can be used in various modes of travel.

Mini programs have different demand scenarios in the three stages of travel. Before travelling, the mini-program is mainly reflected in the aspect of information collection, providing users with query and reservation functions. User needs during travel focus on specific experiences, such as tour information services. At the end of the trip, the mini-program can be used as an information-sharing platform to achieve user retention and even secondary consumption.

Some Use cases:

- Tourism Boards – Integrate destination information, link to travel OTA platform, aggregate tourist data to analyze the needs of tourists. The mini-program of the official tourism bureau of Queensland, Australia not only gathers information on local attractions, food, shopping and hotels but also provides useful functions such as weather, maps, translation, etc., so that users can enjoy services without barriers when leaving the country.

- Shopping Destinations/Malls – online and offline linkage, can attract tourists to the destination through online discounts before the trip, and encourage consumers to share online after shopping. This category is mainly for some business districts or brands. Coupons and promotion information will be issued on some small shopping malls in Hong Kong and drugstores in Japan to attract users to go offline for consumption. And it can also link with WeChat official to issue coupons through official channels such as WeChat’s “Overseas Travel Package” and borrow official traffic to drive traffic to the store.

- Tourist Attractions – provide information and explanations about attractions, provide point-to-point services to tourists, and convert public domain traffic into private domains to further promote the attractions. Some museums and paradise mini-programs not only provide pre-departure ticketing services but can also provide explanations of exhibits by scanning the QR code. Special exhibitions or preferential activities are also displayed daily to attract users to visit again. For example, mini-programs of the National Museum of China, in addition to exhibits guide, convenient information, and current special exhibition information, the content is concise but covers the needs of users.

- Hotels – Pre-booking function, digital services after check-in, and membership system after check-out can retain consumers, and optimize services through data aggregation and analysis. Take the Atour Hotel mini-program as an example. Users can book rooms and use the mini-program to check in & check out. After completing the trip, the membership point system integration will help in brand loyalty & ensure user’s future booking at other destinations with the brand.

- Airlines – Use rich entrances and simple operations to make it easier for users to book air tickets, and the template message of the mini-program can accurately push reminders of flight changes and other reminders for users. Many airlines in China have established their own mini-programs to facilitate users to check-in and receive flight information.

- Cross-border e-commerce – As a lightweight tool, cross-border e-commerce mini-programs can continuously provide users with shopping services at this stage after travel. In addition to the convenience of exchange and payment, logistics, brands establishing cross-border e-commerce mini-programs can also establish stronger connections with brand fans and expand their influence.

Key to success

The product of pan-tourism mini-programs is lightweight. Brands cannot equate mini-programs with official websites or apps. Mini-programs emphasize convenience and address the most urgent needs of users. As an effective marketing tool – mini-programs bring in customers and subsequent conversion is the focus. Due to the relatively low development difficulty, the design of the mini-program can be adapted to various scenarios, so that each travel node is seamlessly linked. As a digital tool – through WeChat user information you can use the data to understand consumer needs.

Talk to us to understand the myriad options for the WeChat mini-program, their development & promoting them effectively.

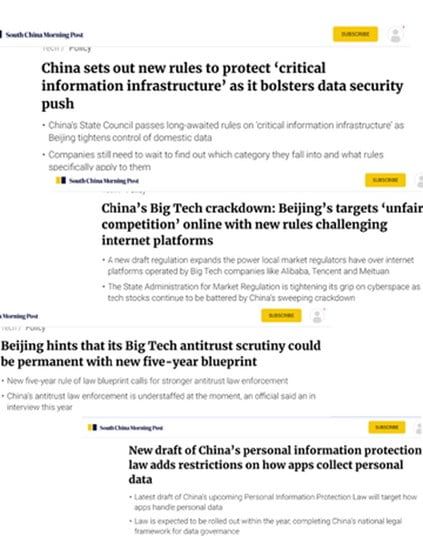

CHINA TECH CRACKDOWN - ANTI-MONOPOLY FINES

In recent weeks, China has been enacting several new laws to protect sensitive data, prevent misuse of personal information & reign in anti monopolistic behaviour. In this series of articles over the next several months, we will be looking into details of some of these areas to try to map out the impact of these decisions on marketing & advertising. Several of the laws are still in early stages, are vague and will require more time and details to get clarity.

TL;DR –

Government Actions

Central and local governments to “improve and enhance anti-monopoly law enforcement”

Protection of “critical Information Infrastructure”

Empower government agencies to target “unfair competition activities”

New updates to Personal Information Protection Law

Impact:

Collection of personal data, how is it shared and used and likely how the advertising community will use it.

More scrutiny of advertisers, advertisements so as not to fall foul of the law

Some good news, less restriction on cross-linkages between super apps like Tencent & Alibaba – currently cannot link to Tmall within WeChat, etc.

On the morning of July 24, the State Administration of Market Supervision (SAMR) issued an administrative penalty decision on the illegal implementation of monopoly by Tencent in acquiring equity of China Music Group and ordered Tencent and its affiliates to remove exclusive copyrights and stop high amounts. In addition, Tencent is required to report to SAMR on the performance of its obligations every year for three years.

In recent years, China’s regulatory authorities have repeatedly investigated Chinese Internet companies under the “Anti-Monopoly Law” and have successively punished many well-known companies. This has also sounded the alarm for many Chinese Internet giants.

Strong Punishments

At the end of 2020, the SAMR imposed a fine of RMB 500,000 on Alibaba Investment, Fengchao Network, and China Reading Group. In these three cases, in accordance with the provisions of the Anti-Monopoly Law, SAMR acquired the equity of Yintai Commercial (Group) Co., Ltd. from Alibaba Investment Co., Ltd., and China Reading Group acquired the equity of Xinli Media Holdings Co., Ltd., and Shenzhen Fengchao Network Technology Co., Ltd.’s acquisition of the equity of China Post Smart Delivery Technology Co., Ltd. and other three cases of failure to declare the illegal implementation of monopoly were investigated.

In July, the regulatory authorities imposed penalties on 22 cases of illegal monopoly in the Internet field, and also imposed fines of 500,000 yuan on the companies involved.

Also in July this year, the merger of the two live broadcast platforms Huya and Douyu was suspended due to anti-monopoly supervision. The financial report shows that in 2019, Douyu’s turnover was about 7.2 billion yuan, and Huya’s turnover was about 8.3 billion yuan. According to the above data, the turnover of Douyu and Huya far exceeds the required amount to be declared, and they cannot be merged until approval is obtained.

From the end of 2020 to the first few days of Tencent Music’s fines, the frequency of penalties for antitrust cases by China’s regulatory authorities has increased, and the severity of penalties have also increased.

Alibaba’s hefty fines

Since 2015, Alibaba Group has abused its dominant position in the domestic market by asking merchants on the platform to “choose one” and prohibiting these merchants from opening stores or participating in promotional activities on other platforms. Alibaba has also borrowed market power, Platform rules, data, algorithms and other technical means, adopt a variety of reward and punishment measures to ensure the implementation of the “choice of two” requirements, maintain and enhance its own market power, and gain an unfair competitive advantage.

In April, China’s State Administration for Market Regulation accused the e-commerce giant Alibaba Group of violating the Anti-Monopoly Law and fined it 18.228 billion yuan (US$2.78 billion), the highest amount ever in China’s Anti-Monopoly Law.

Warnings and opportunities

The numerous fines that China has issued to Internet companies in anti-monopoly are a reminder when companies invest and operate, and they also provide a fairer environment for market participants. According to the “Anti-Monopoly Law” and the “Provisions of the State Council on the Standards for Declaration of Concentration of Undertakings”, before a merger, an enterprise should conduct an assessment and make a declaration in accordance with the law.

For ordinary market participants, the severe penalties imposed on Internet giants by the regulatory side is undoubtedly good news. Take the case of Tencent Music as an example. Tencent Music owns more than 80% of the exclusive music library, which enables it to obtain more exclusive copyrights from copyright owners on more favourable terms, and may also be able to increase market entry barriers, and has or may have exclusions on relevant markets. Strict anti-monopoly supervision has given other smaller companies a living space and more opportunities for development.

Finally, we will broadcast the latest news. China passed the “Personal Information Protection Law of the People’s Republic of China” on August 20, 2021, and will come into force on November 1, 2021. This will further improve the personal information processing rules, and make targeted regulations on applications (App) excessive collection of personal information and other behaviours.

To understand further the impact on advertising, how to navigate the constantly shifting minefield, talk to us.

INSIGHTS OF WECHAT LUXURY BRANDS 2021

“The WeChat Luxury Index 2021” by DLG and JINGdigital provides insights based on non-public data to allow luxury brands to benchmark their performance in the industry. WeChat is a social messaging and media platform launched in 2011, expanded the range of service from payments to e-commerce solutions. It has now more than 1.225 billion monthly active users (MAU) as of March 2021. WeChat is now an integral part of every brand’s digital strategy in Mainland China.

1. Acquisition – follower recruitment-related metrics

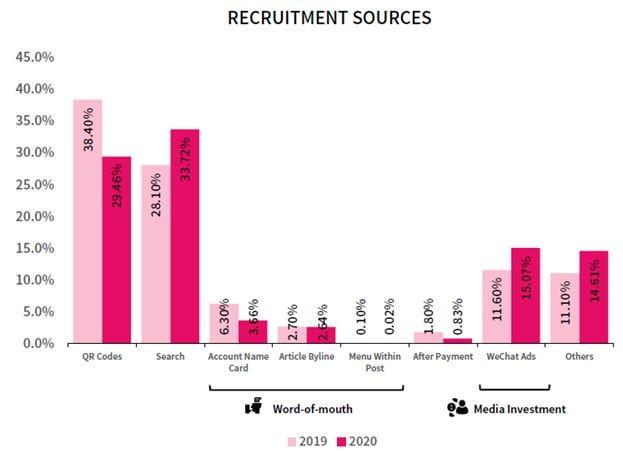

Brands experienced different rated of growth in their WeChat communities in 2020, as report mentioned, larger accounts is facing a general slowdown growth rate since 2018 while small accounts has picked up pace. Brands must be even more aggressive and innovative in their fan acquisition and retention strategies as WeChat communities grow larger and more saturated with brands.

Based on data shown, Search has the highest percentage of 33.72% among others recruitment sources in 2020, followed by QR code. Consumers tends to make use of WeChat as a search engine for example by tags, Mini Programs, etc which also helps to boost the organic traffic to brand accounts.

Brands can derive a realistic growth target based on the formula given below:

Another concern of follower recruitment is that losing some existing ones with every content push, thus implement audience segmentation can help to minimize the unfollow rate. By tailoring the audience’s interest in the content, they are less likely to find the weekly content push is annoying, results in a longer follower lifespan.

2. Engagement – examines both fan and post engagement statistics

There are few engagement actions can be tracked with the possible of using a social CRM back-end in place and within the Official Account environment. Below are the actions tracked for the purpose of the study from the report: –

- Menu clicks, Messaging, QR Codes, Post Interactions (link clicks, comments, likes, shares, WOW)

Other trackable actions can be tracked through behaviours on Mini Programs and other web assets using the WeChat JSSDK, below are some of the examples (not included in the study): –

- Mini Program activity, Follower data collected via forms, Product preferences based on interactions, Conversions on Mini Programs

The report showed that menu clicks on brand Official Accounts which is accessing information related to the brand formed the top engagement action type in 2020, followed by E-commerce-related menu clicks while the lowest is CRM on Official Accounts. E-commerce-related interaction could be caused by pandemic and brands should still develop strong CRM and membership programme.

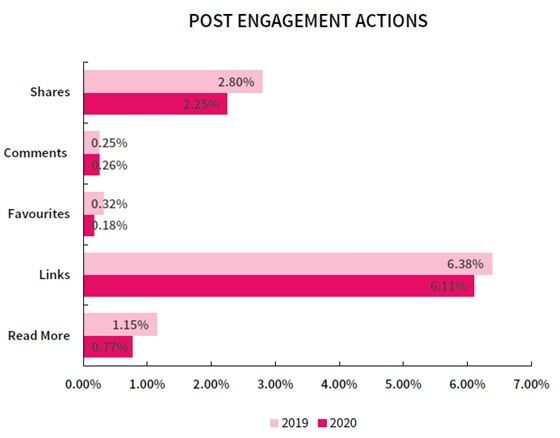

Link clicks is still the most popular engagement type for post interactions in 2020. Therefore. Brands should concentrate on establishing a clear linking strategy and ensuring that clear calls-to-actions are included in strategic locations across articles. WOM potential of WeChat remains low and this is indicated by interactions like comments, favourites and shares have fairly low engagement rates.

Link clicks is still the most popular engagement type for post interactions in 2020. Therefore. Brands should concentrate on establishing a clear linking strategy and ensuring that clear calls-to-actions are included in strategic locations across articles. WOM potential of WeChat remains low and this is indicated by interactions like comments, favourites and shares have fairly low engagement rates.

As the WeChat ecosystem becomes more crowded with businesses and information, the ability to customise and optimise the content that appears in a user’s chat feed will help the piece stand out more, boosting the likelihood of viewers engaging with it. The engagement rate for articles sent to segmented audience groups is at 10.2%, higher than average in-article engagement rate of 9.56%. This is showing that audience segmentation can help to increase the in-article engagement of their followers. Best practice for audience segmentation is that brands need to:

- Clearly define the stages and goals along the consumer journey

- Identify what information is required from consumers to communicate effectively

3. Content – frequency of posts, opening rates and content performance

Based on the report, 56.8% of luxury WeChat Official Accounts made four pushes a month in 2020, a decrease from the 67.5% of brands that did so in 2019. Brands appear to be publishing content less regularly than in the past. This could indicate that brands prioritize quality over number when it comes to content creation, allowing them to better allocate their resources.

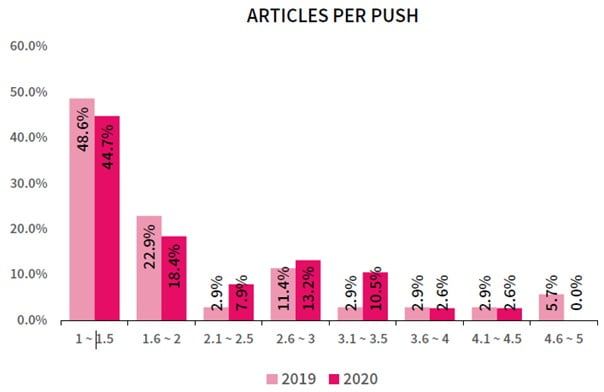

The study showed that more than half the brands are pushing 1 to 2 articles per push in 2020. Very few brands are publishing more than 2 articles per push. Brands appear to be focusing their efforts on producing higher quality with fewer pieces of content in general.

The average open rate for all articles pushed by luxury brands in WeChat dropped in 2020 as of 8.03%. It has been noticed that cumulative open rate od multiple article pushes are higher than single article pushes. Therefore, io increase open rates without dramatically increasing expenditures, brands should consider generating and working with a pool of sub-articles that can be easily reused. A sub-article pool allows brands to communicate key topics with followers and it can be customized based on specific user segments for example: –

- Sales/Conversions: Such articles usually include elements like store locators or e-commerce links, which are aimed to boost conversions and drive revenue.

- CRM: These articles are aimed at reactivating consumers and directing them to services or a loyalty programme.

- Ad-Hoc: These articles are created whenever the brand has a new launch or event to publicize.

Brands can carry out A/B Testing on the different audience segmentation to determine the best type of content positioning, the best day and time to publish content or even test out new article layouts. Open rates and engagement rates can be improved in the long run as a result.

4. Key Opportunities 2021 – new functions in the WeChat ecosystem that brands can leverage

- SMS to Mini Program

Brands can make use of SMSes into Mini Programs to drive e-commerce sales, onboard users to membership programmes and even connecting them with sales associates (SA) for example starts with sending messages to redirect consumers to the Mini Program when promoting a new product. Brands also can drive consumers to its WeChat Official Account to explore more information or become a follower after binding users to the membership programme on the Mini Program. Other conversion opportunities also including repurchase opportunity, cross-selling opportunities, loyalty programs and so on.

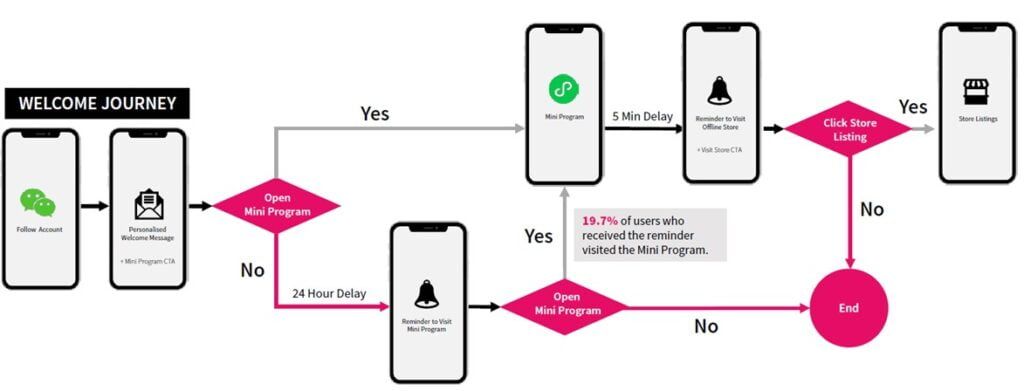

- Marketing Automation

Marketing automation can trigger communications after selected actions take place on WeChat by utilizing the 48-hour window. Within 48 hours of their first encounter with the Official Account through the WeChat Customer Service API, marketers will be able to send an unlimited number of unsolicited messages to a follower via the integrated SCRM platform.

- Social Commerce

Brands can utilize the social platform cross-linking functions to keep users within their ecosystem. For example, brands can include a direct link to their Mini Programs on WeChat for a fee or drive consumers from other social platforms such as Weibo and RED to WeChat Mini Programs, allow consumers to discover more and purchase the products.

Other ways to drive conversions on WeChat through Mini Programs including a permanent store, product drops or pop-up store that all can be managed through WeChat Mini Program. Also, brands can host a live stream on a Mini Program to attract users to make in-app purchases.

If you are interested to get more information about the insights or case studies, you are welcomed to request from us.

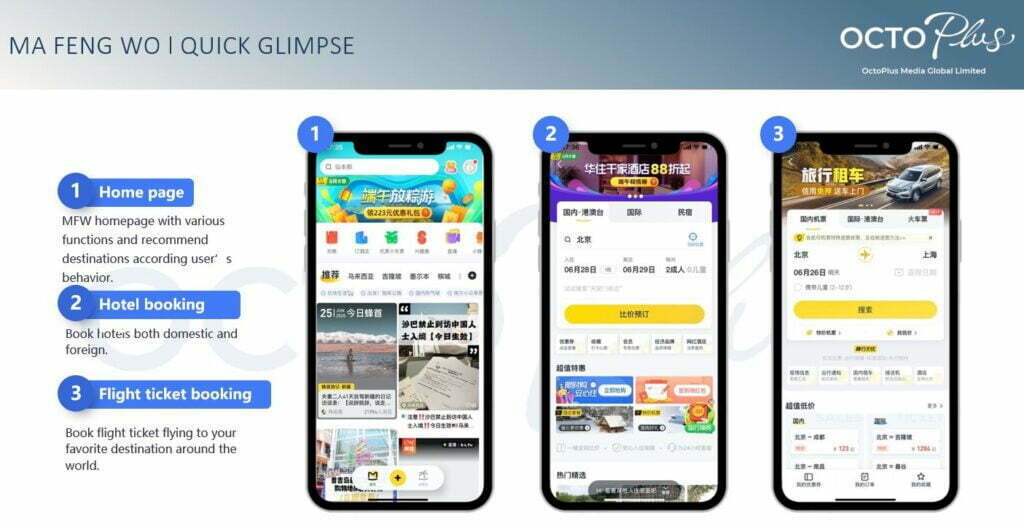

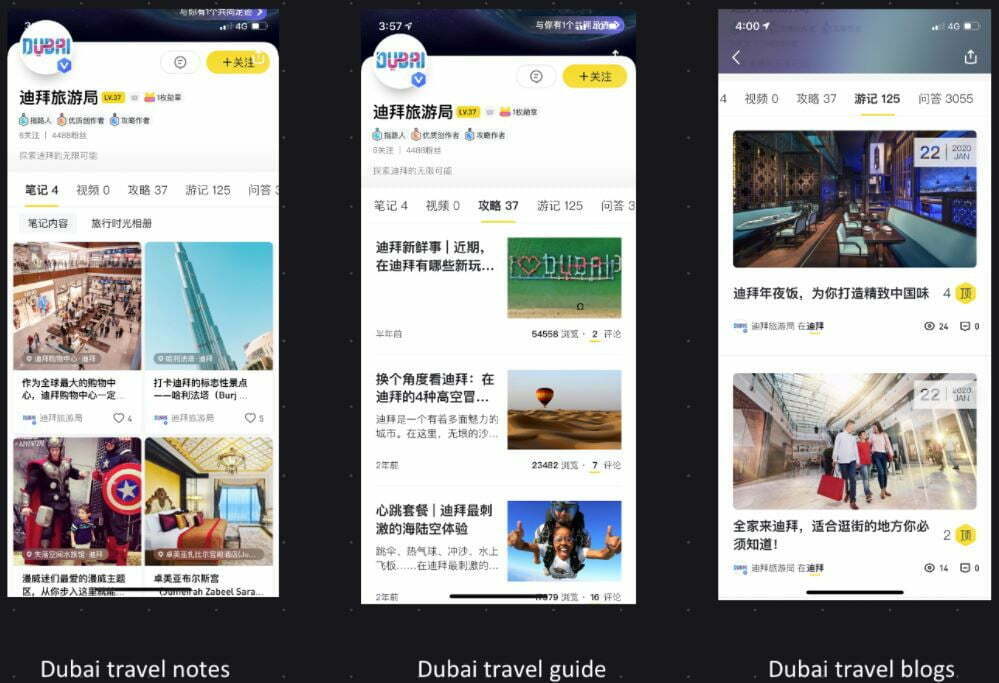

APP OF THE MONTH – MAFENGWO

MaFengWo (马蜂窝) is the leading travel & leisure platform in China. Initially they started as a platform to share information about travel but went to establish as OTA later. Users on the platform share their journeys, travel tips, itineraries, recommendations, and feedback with other users on the platform. Over 700,000 long-form content created every month, 10 Million short form and total daily data generated excess 3 TB. MaFengWo provides content for every aspect of travellers journey – before, during & after.

- Content Marketing:

As MaFengWo prides on long-form content, the focus for them is on providing detailed long-form content marketing to brands & agencies.

- Travel Guide:

The travel guide is usually an in-depth guide that provides richer travel references. This is usually written by professional MFW editors. Topics usually can be a themed reference to travelling around the destination. Professionally organized content usually included an introduction to scenic spots and experiences

- Travel Notes:

Short content to inspire travel interests.

Record travel experience by picture/short video, share travel mood.

- KOL Travel Blog:

Work with top KOL to write destination-specific experience. KOLs are usually travel experts & enthusiasts, followed by a huge number of MFW users. Their High-quality travel blog will usually influence the other users’ travel decisions.

Travel Blog usually contains an aggregation of information, it aims to inspire users & offer practical references.

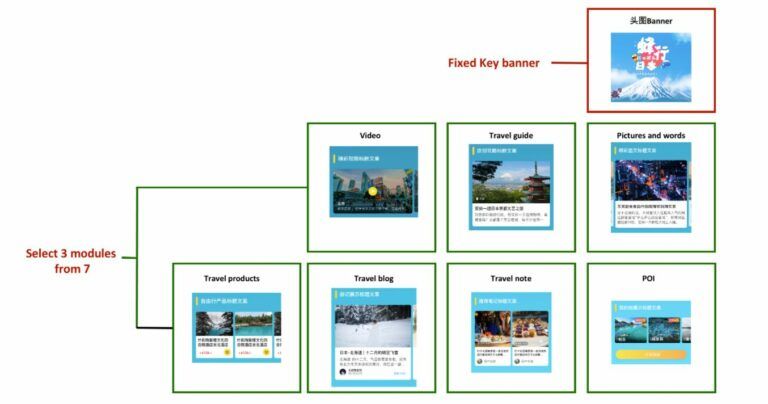

Mini Website:

Elegant microsite developed within MFW. Various content can be used to create a complete interactive site. Existing travel notes, travel guides, POI products, videos & banners can be used.

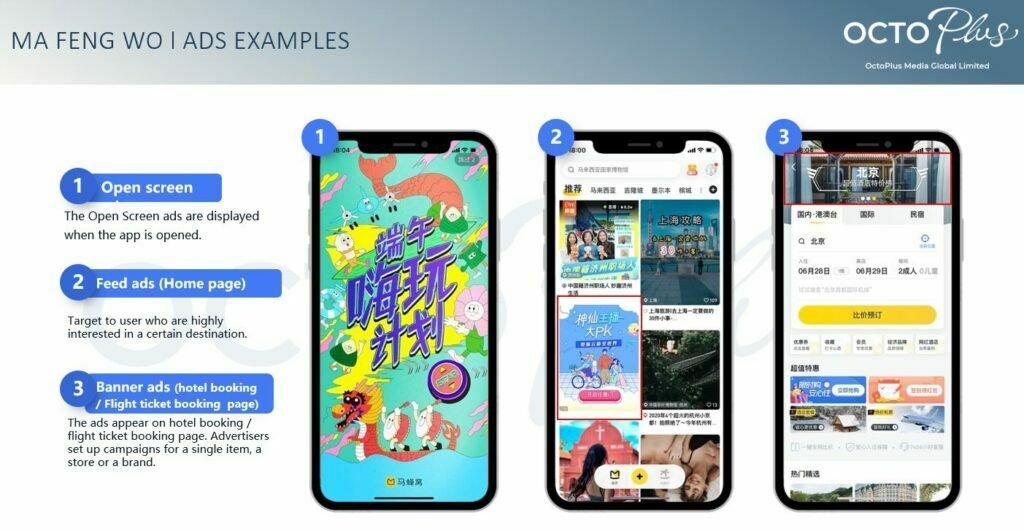

In Additional to long-form content, advertisers can also run traditional banner or video ads on CPT or CPM basis.

For more detailed information about MaFengWo, please contact us.

-End of the Newsletter-

Feel free to talk to us

It’s a team with one single shared goal, which is our client’s success. Deliver results for your business now.