2022 China’s Financial Advertising Trends

Since Q2 of 2022, China has started implementing many regulatory measures in the financial field. For example, the General Office of the State Council of the People’s Republic of China is encouraging securities, funds, guarantees and other institutions to reduce service fees further.

According to the “Big Data Insights – Financial Advertising Trends” published by AppGrowing’s professional mobile advertising intelligence analysis platform, the following is a compilation of the Chinese financial industry’s key data analytics and advertising strategies in 2022.

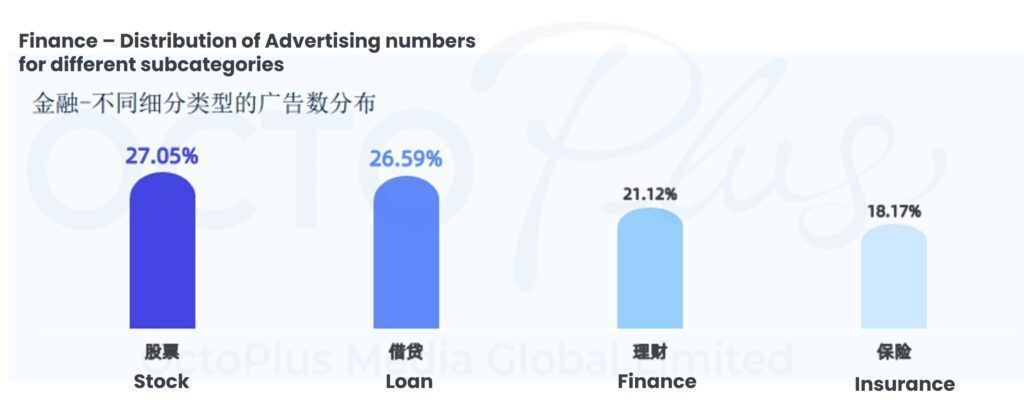

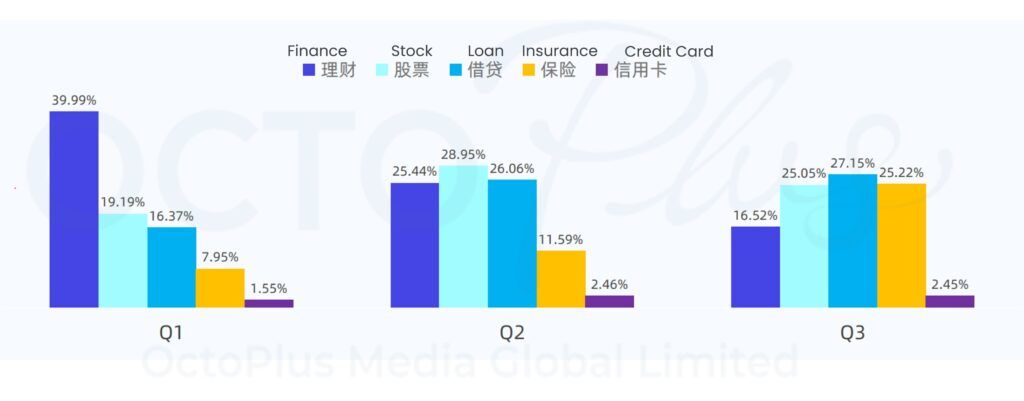

The proportion of investment in the financial industry showed an overall upward trend from January to August, ranking 7th or 8th in the industry. Among the advertising distribution for different promotion purposes, 92.6% of the advertisements were formed fill-up ads, and the remaining 7.4% were APP downloads. The distribution of advertisements in financial sub-categories is stocks (27.05%), loans (26.59%), wealth management (21.12%), and insurance (18.17%). The proportion of investment in wealth management has declined, but the ratio of investment in stocks, loans, and insurance has increased. Stocks and loans are still the main types of financial investment.

Key platforms in the financial industry include Baidu Marketing, Tencent Advertising, Ocean Engine, Kuaishou Magnetic Engine and NetEase Ads.

Financial advertising can be divided into 4 types as follows:

Stocks: The largest proportion of 27.05% and continuing to grow, with a strong presence on each platform, especially Baidu Marketing.

Loans: accounted for 26.59% of the investment, Q2 investment growth is significant, similar to the stocks category, advertising was invested in various platforms, with Tencent ads accounting for the largest share and Kuaishou Magnetic Engine being the least.

Wealth management: The proportion of investment is 21.12% showing a downward trend. The majority of the investments are concentrated in Kuaishou Magnetic Engine and the least in Baidu Marketing.

Insurance: the smallest proportion of investment was 18.17%, and investment in Q2 increased significantly. The main investment went to Kuaishou Magnetic Engine, although it was relatively less compared to the financial management category.

Key Category: Financial Hot Investment List (Form Retention Category) Top 5 (ranked in order from first to fifth)

Loan: 360Jie, Paipaidai, Fenqile, XiaoYing X-loan, Huan Bei Loan

Wealth management: China CITIC Bank, WeBank, China Merchants Bank, Jufeng Investment Advisory, Shanghai Pudong Development Bank

Insurance: Yuanbao Insurance, ZhongAn, Paipaidai, Taikang Life Insurance, Shuidi Insurance

Q1 to Q3 Financial Hot Investment Top 3 (ranked in order of first to third)

Q1: Alipay, iQiniu, Du Xiaoman

2: Alipay, iQiniu, 360Jie

Q3: Yuanbao Insurance, 360Jie, iQiniu

APP download category Q1 to Q3 Financial Hot Investment List Top 3 (ranked in order of first to third)

Q1: JD Finance, Gushi Yingjia, Xingyong Qianbao

Q2: Gushi Yingjia, Gaoneng Zhitou, East Money

Q3: East Money, Tonghuashun Shouji Chaogu Gupiao Ruanjian, Gushi Yingjia

Key advertising traffic media include Ad Network, QQ, QQ Browser, Tencent News, Fanqie Novel, CSJ Platform, and so on. Among the creative formats, vertical video ads account for the largest share, followed by video, and the lowest are image ads.

Hot advertiser targeting strategy

Stocks: Generally, free stock consultation is used as a selling point for advertising, or to promote the function and trend analysis of stock diagnosis to entice users to click and invest, as well as many related advertising words such as “stock”, “stock diagnosis”, “compass”, “trading” and so on.

Loans: In general for Capital ads, advertisers usually emphasize high maximum loan amount and fast lending, such as “the fastest hour/one minute in the account”, advertising words such as “borrow money”, “lack of money”, “quota”, “loan” and so on.

Insurance: Most of the popular advertising points are the launch of medical insurance or critical illness insurance, including “medical insurance”, “critical illness insurance”, “sum insured”, “protection” and so on.

In addition, there are common routines in financial advertising such as interviews with financial experts, interviews with passers-by on the street and experts teaching on stage, mainly through interviews to introduce or prompt product features, and using pain points to arouse users’ interest in the product.

The above is the main data analysis in China’s financial industry advertising in 2022, if you want to know more about advertising details, please contact us!

Feel free to talk to us

It’s a team with one single shared goal, which is our client’s success. Deliver results for your business now.