China Marketing Insights Monthly Newsletter [March 2021]

![China Marketing Insights Monthly Newsletter [March 2021]](https://cdn.octoplusmedia.com/wp-content/uploads/2022/09/China-Marketing-Insights-Monthly-Newsletter-March-2021-1-l-OctoPlus-Media-1024x524.jpeg)

Hello,

Welcome to our March Newsletter.

China is further easing restrictions for both domestic & international travel. From March 16th, Chinese residents will be able to travel freely – all they need is a ‘green’ health check. China has also rolled out international vaccine health certificate. It hopes that other countries will reciprocate making global travel easier.

Our data partner, Getui, has released the New year travel data report – we cover key insights and analysis from this report. In this newsletter we also cover a key report from Alimama about online consumption of luxury goods.

We have an update on WeChat mini-program and their ever-expanding ecosystem. . As the battle for video sharing app supremacy intensifies, we deep-dive to provide key comparison between Bilibili, Douyin, and Kuaishou, we wrap up this newsletter with App of the month – Weibo, its salient features & advertising options.

From all of us at OctoPlus – Stay safe & take care.

Sincerely,

Mia C. Chen

CEO & Co-Founder of OctoPlus Media

GETUI-2021 SPRING FESTIVAL TRAVEL DATA REPORT

China government was very cautious and discouraged travel during the long festive holiday, and recommend to spend the Spring Festival and enjoy traditional Chinese culture in the cities where they work to avoid the spread of COVID-19. Getui big data observed and analyzed the population traffic in major cities during the Spring Festival with the pre-sale of tickets from some APPs such as 12306 and ZhiXing Train Tickets. Results showed that ticket sales during the Spring Festival were relatively stable.

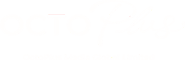

According to Getui big data, the average activity of train ticket booking apps during the pre-sale period in 2021 was only 53.6% of the same period last year, a decrease of 46.4%, and the activity of return train ticket apps after the Spring Festival was even lower, which was 33.1% of the same period last year, a decrease of 66.9%. According to the data, the number of people leaving the cities where they worked and returning to their hometowns decreased significantly compared to the year before.

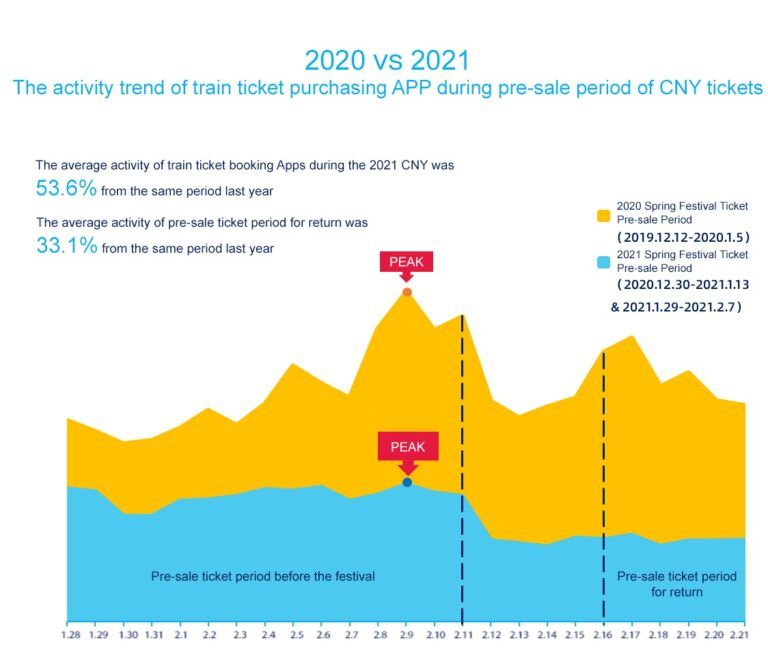

The report indicated that in the last 7 days leading up to the Spring Festival, the number of people returning to their hometown from 19 first-tier and new first-tier cities dipped compared to last year, with the highest drop of over 70% and the lowest drop of nearly 50%. The top 3 cities in terms of people leaving this year were Guangzhou, Shenzhen, and Chengdu. In the same period last year, the top 3 cities were Guangzhou, Beijing, and Shenzhen.

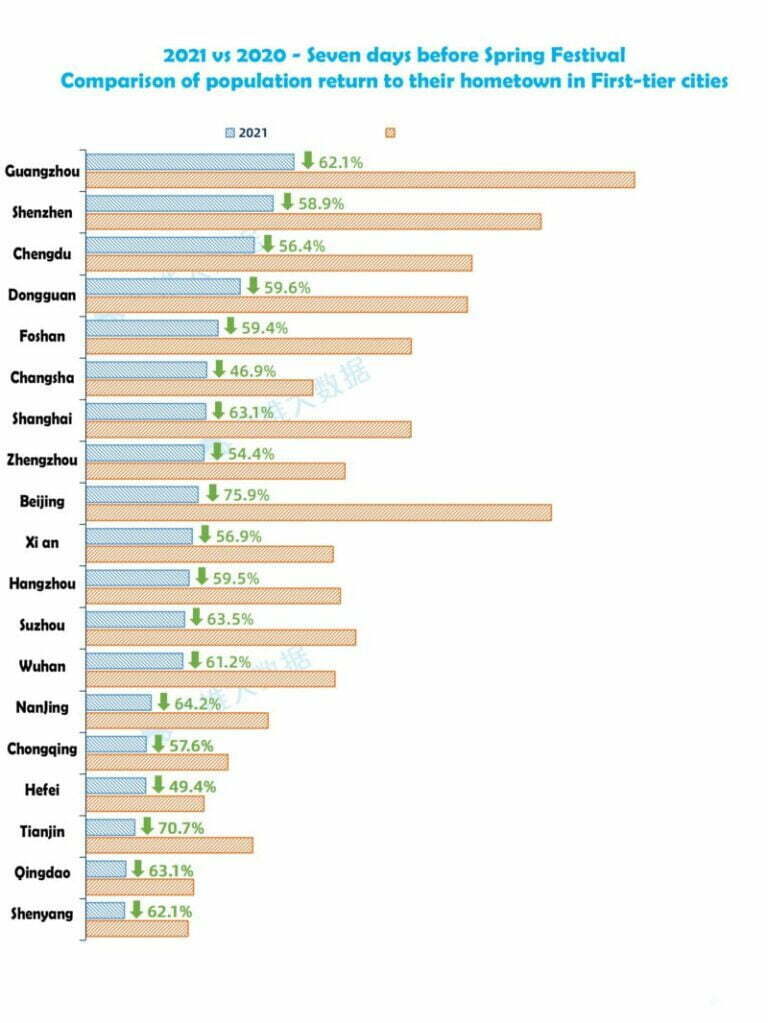

User profile of people returning to their hometown during the Spring Festival in 2021:

- Male: Female 54%:46%

- ≤ 24 years old: 18.3%. The proportion is much lower than last year. This indicates that younger people are more cooperative with the country’s prevention and control measures

- 25-44 years old: 61.7%.

- People with medium consumption levels: 54.8%.

Getui is our early partner and one of the lead data providers for China Data Bank™.

China Data Bank™ is an UnDMP – a new class of data solutions that is focused on providing the right data solutions to all advertisers and without the overhead of complex data requirements stipulated by the China Government. Initial partners for the venture include the likes of Alibaba Unidesk, Tencent Marketing, Getui, China Unicom, UnionPay, JD, etc.

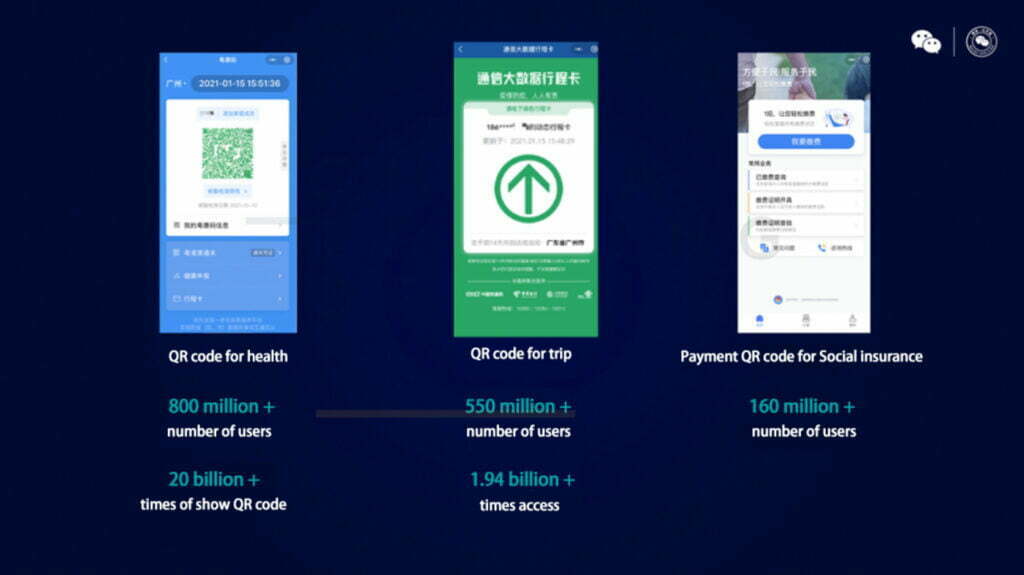

THE EVER EXPANDING ECOSYSTEM OF WECHAT MINI-PROGRAM

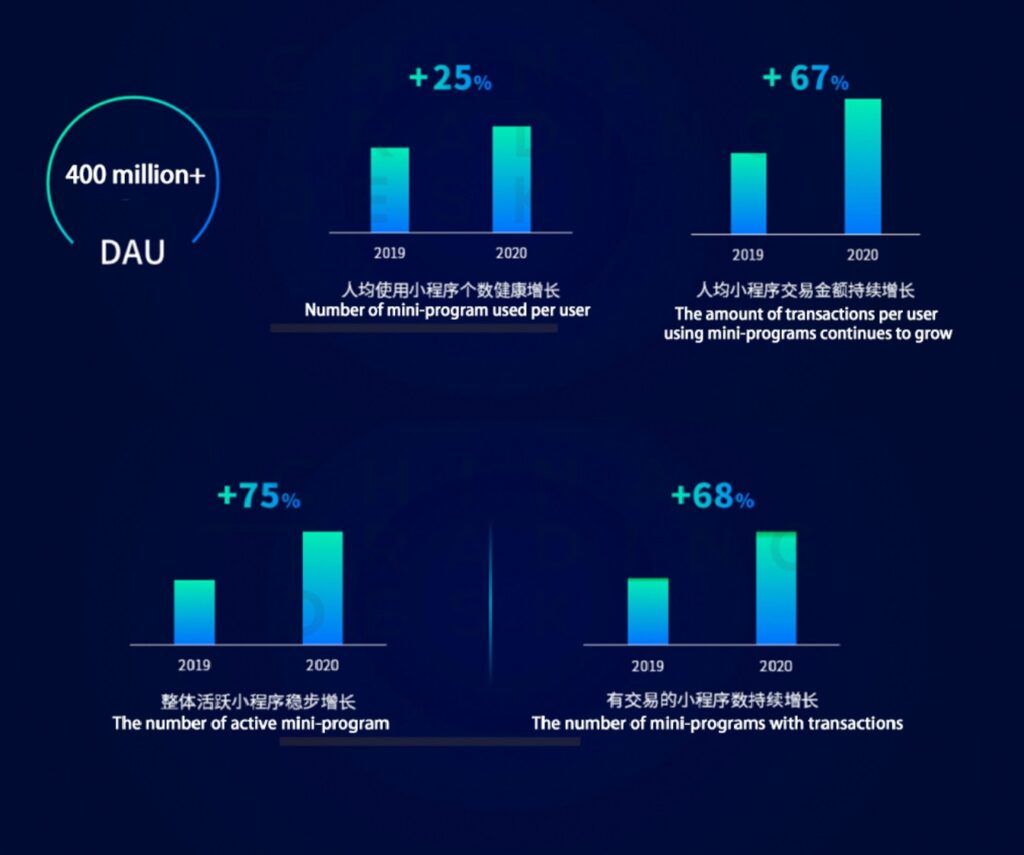

The WeChat mini-program team announced that the average annual DAU of mini-program exceeded 400 million in 2020, and the annual cumulative transaction volume increased by more than 100%. The mini-Programs have given full play to the value of epidemic prevention in the last year. The health code has served more than 800 million users, and the QR code has been displayed for more than 20 billion times; the epidemic prevention itinerary card has accessed 550 million users and the cumulative number of visits reached 1.94 billion. Effectively increasing Inspection of front-line epidemic prevention points and traffic efficiency; In the past year, the Social insurance mini-program has helped 160 million users realize online insurance without leaving their homes. During the epidemic, mini-programs helped businesses re-establish direct channels with users, the diversified services and business ecosystems are gradually improving.

WeChat mini-programs average daily active users exceeded 400 million and the total sales (GMV) more than doubled compared to last year while the number of Mini Programs used per user and the average transaction value increased by 25% and 67% Y-O-Y respectively. WeChat mini-programs have helped brands and businesses to easily embrace digitalization and enable direct access to hundreds of millions of stay home consumers during the pandemic. Today, the services are used in a variety of sectors with transportation, departmental stores, apparels, and sporting goods leading the growth.

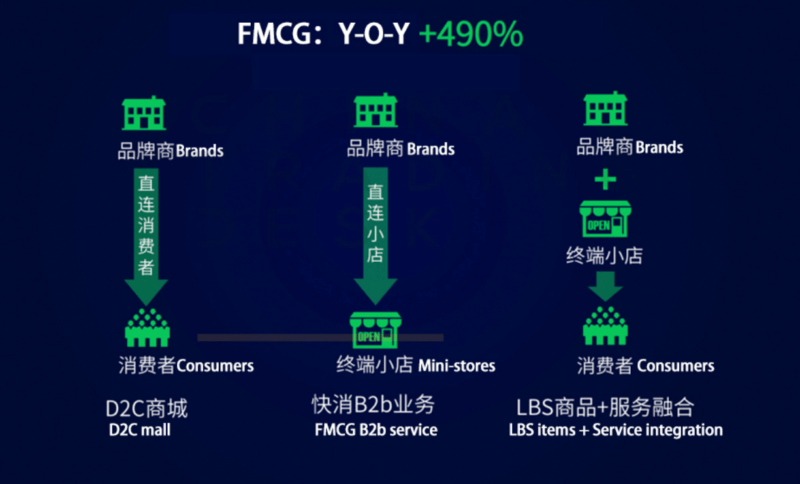

WeChat mini-program has become the most efficient carrier for FMCG brands to connect consumers and terminal stores.

Specifically, the online penetration rate of FMCG brand D2C mall has increased, with an annual growth rate of 490%.

The retail channel is based on the advantages of mini-programs low threshold, the community + mini-program has become the standard allocation of community group purchase. Mini-program pre-sale + self-service pick-up mode improved the increase of offline traffic to the store, but can also effectively complete the secondary transformation. The GMV of the retail industry increased by 254%.

Through the cooperation of multiple products of Service account, WeChat Work, and mini-program, brands are able to maximize the operation of stores and shopping guide resources. Meanwhile, a growing number of luxury brands have defined mini-programs as official online stores that launching limited collections and new products. The GMV of fashion brands grew by 216% a year.

B2B store assistant

Mini-program launched B2B store assistant, through the access of plug-in capability, to help brands and distributors to complete the effective connection of terminal stores, mainly focusing on solving 2 problems:

- Assisting brands and distributors identify real stores based on WeChat basic capabilities to ensure the effectiveness and authenticity of stores

- Provide brands with store-oriented message reach capabilities, ensuring that messages are delivered promptly, and improve the operational efficiency of the company’s distribution system

Mini-program help small and medium-sized businesses start an online business

WeChat mini-stores have now opened 34 first-level categories after the expansion, including shopping, life services, tourism, education, etc. and it will continue to expand to help businesses from all walks of life to open stores on WeChat.

In terms of functionality, WeChat mini-stores are also continuously optimizing customer acquisition, conversion, retention, and dissemination:

Enrich marketing forms: launch a variety of coupons and flash sale;

Create a new customer acquisition scene: support mini-stores associated video account, purchase guide, and distribution, etc., improve the ability of mini-stores to promote customer acquisition.

WeChat service platform: Linkage with ecological partners to provide product management, order, distribution, marketing, ERP, and other personalized expansion services to better meet the personalized needs of merchants;

BILIBILI VS DOUYIN VS KUAISHOU - KEY COMPARISON

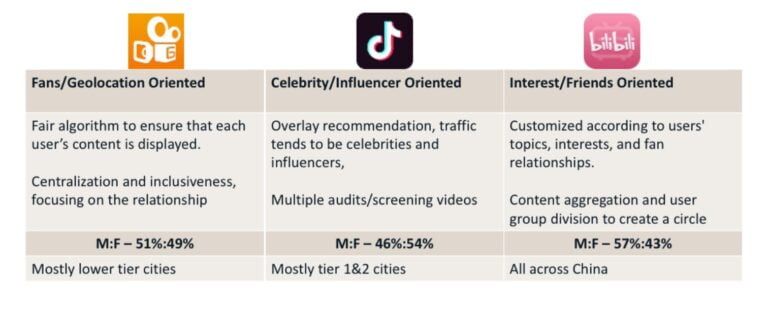

As live streaming & video consumption has increased dramatically, we see 3 apps as clear front runners in this space. In this blog post, we compare & explain the 3 different apps.

- Bilibili – a platform that originated as a manga site, now a very active video platform, often dubbed as “youtube of China”

- Douyin – the short-form video app and Chinese version of TikTok – although Douyin existed long before TikTok

- Kuaishou – similar to Douyin, but more popular in lower-tier cities.

- User Profile:

Kuaishou:

- Male: 50.1%

- Female: 49.4%

- 80%+ are born in the 90s, most users from lower-cities.

Douyin:

- Male: 45.98%

- Female: 54.1%

- Most users from 1st and 2nd tier cities.

Bilibili:

- Male: 57%

- Female: 43%

- The average age of most users is 21 years old.

- Core Algorithm:

- Interactive Features:

Kuaishou is good to create interactions, while Douyin prefers to use content recommendation algorithm to bring higher public traffic. Users on both platforms prefer thumbs up to comments; Humorous KOL has the highest number of interactions on both platforms.

Compared with Kuaishou and Douyin, Bilibili’s users prefer to express their support for bloggers through interactions such as forwarding, comment, and like. The real interaction is bullet comments, it has become a unique culture for Bilibili.

- Content:

Kuaishou: The content of the platform is more life-oriented and diversified, users are more inclusive for content. The top five most popular content are beauty, fashion, humour, music, drama, and games.

Douyin: The content is younger and more fashionable, using popular songs to attract young users to pursue fashion trends, and the content can be easily imitated. The top five most popular content on Douyin are Little Sister, Little Brother, Drama/Humour, Dance, and Music.

Bilibili: The content is mainly from PUGC. What impresses users most is the bullet comments, ACGN (二次元) and the non-mainstream users (非主流). The video of Bilibili has more than 7k main categories and over 800 content labels.

ALIMAMA-INSIGHTS INTO ONLINE CONSUMPTION OF LUXURY GOODS

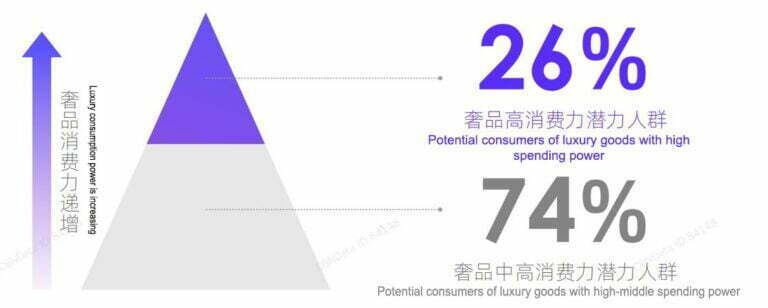

In the luxury consumer market, 74% of people with medium and high spending power potential are entry-level consumers with slightly lower purchasing power. Luxury goods purchased by these group of consumers is done beyond their means and are fans of fashion and entertainment. As for groups with high consumption potential, they are mostly social elites, white-collared workers and professionals who enjoy the finer things in life and are fashion conscious and relate well with content consisting of influential individuals. Their purchase of luxury goods has become the “consumption inertia” in their life.

Key insights from the report:

- People with high consumption of luxury goods: they prefer to purchase by installment and purchase on behalf of others

- High potential consumers in luxury goods: Preferred Ole Store or discounted goods

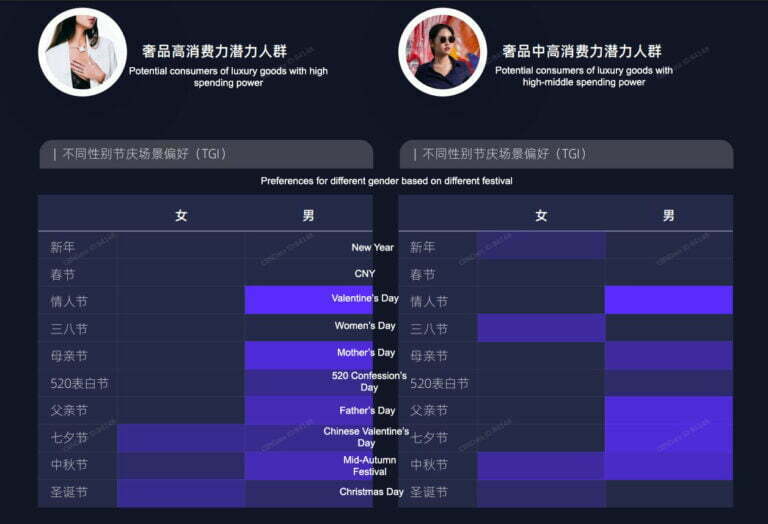

Luxury consumption preference

- Brand influence, festival scenes, and product styles are all the focus of luxury consumption, especially for potential groups with high consumption power, the limited goods are one of the stimulus factors, but the middle &high potential consumers are more likely to be driven by price factors.

According to data, be it high spending power or medium-high spending potential group, male consumers are more likely to give gifts than female consumers. Hence, men are a group worth focusing attention to for brands during the festival.

- KOL is the media carrier of luxury goods. For middle & high-end consumer groups, they pay attention to designers, artists, models, etc. But for high-end consumer groups, they pay more attention to celebrities and KOL.

Consumers with high consumption potential prefer the APPs of pictures or lifestyle and are more interested in information and photography. Consumers with medium & high consumption potential are more interested in video and music content platforms. Therefore, brands may refer to the following APPs for marketing

- High-end consumer power user is interested in: RED (Little Red Book), Netease News, Korean TV, Meitu Xiuxiu, Beauty Camera, Mama, etc.

- High & medium-end consumption power users interested in Youku, QQ Music, Netease Cloud Music, Meetyou, XiaChufang, etc.

APP OF THE MONTH - WEIBO

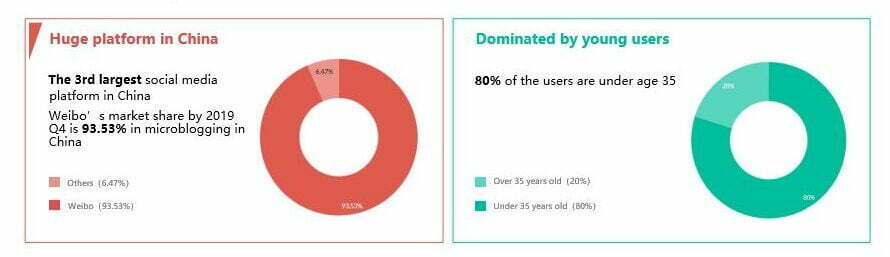

Sina Weibo is the first open Social Media platform in China, with over 511 million MAU (Till Sep 2020), an increase of approximately 14 million over the same period last year. Approximately 94% are mobile users. Advertising and marketing revenue was US$416.7 million, a year-on-year increase of 1%. It is where netizens, celebrities, the government, and brands meet, debate, share their thoughts and feelings with text, images, and videos. It is China’s pulse.

Most of Weibo’s revenue comes from advertising sales and marketing services. It helps its advertising and marketing clients promote brands, products, and services to users. Weibo offers a wide range of advertising and marketing solutions for clients. It develops and continues to refine user portraits so that customers’ marketing activities on Weibo have better accuracy, activity, and promotion efficiency.

Weibo Ads: Infeed ads & Brand ads

Infeed ads:Fan Tunnel (粉丝通)

Fan Tunnel enables the brand to cater to a much larger target audience because it sources from Weibo’s large user base. You can define your target audience demographics by age, gender, region, interests, and even the type of devices used. Therefore, Fan Tunnel can target audience precisely and accurately. Fan Tunnel is a very specific and focused way to advertise on Weibo.

Infeed ads:Fan Headline (粉丝头条)

Fan Headline is based on users existing followers and looks for potential relationships with their Weibo friends, who are considered users’ potential followers. It offers quick and efficient promotion of Weibo posts and accounts based on the daily updates and social networks of the target audience.

Infeed ads:WAX(Weibo AdeXchange)

WAX(Weibo AdeXchange) is a programmatic advertising trading platform provided by Sina Weibo to various advertisers. The platform has a daily average of 100 million advertising traffic on Weibo. Excellent advertising resources and precise data make programmatic marketing more effective. Users can generate in-depth interactions with advertisements, such as comments, likes, and follow. Through real-time bidding, advertisers can choose a suitable DSP as a service provider. WAX can provide accurate Weibo DMP data to improve advertising effects.

Brand Ads: Open screen ads, Hotspot window ads

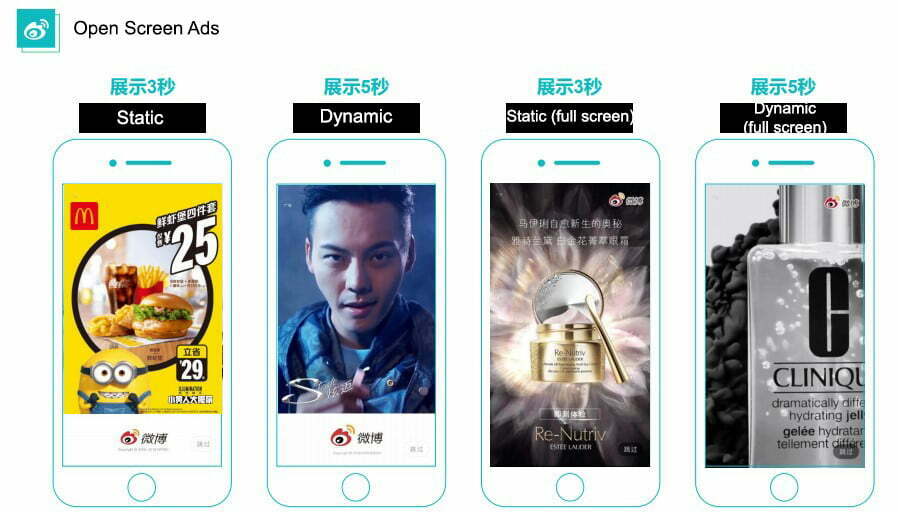

- Brand ads:Open screen ads

When the user opens the Sina Weibo mobile APP, a full-screen ad is displayed to all users accessing the app.

- Brand ads:Hotspot ads

Weibo hotspots window ads attract users’ attention through large pictures and stimulate their interest in watching and participating. In terms of content, combined with selected top hot content, users can quickly understand the latest news.

Brand ads: Brand awareness

Weibo has launched three programs – Ju Baopeng, U Wei-Plan, and Brand Express, to help brands achieve the “combination of brand and awareness” more effectively.

- Ju Baopeng connects advertisers and celebrities, to help advertisers find suitable celebrities quickly, to carry out more efficient marketing with the help of their influence to improve marketing efficiency.

- “U Wei-Plan” is a comprehensive solution of social interaction and consumption jointly created by Weibo and Alibaba, aimed to achieve full link communication with users from brand recognition to interest generation, purchase behavior, brand loyalty formation.

- Brand Express: It is a Weibo feed ad with “strong exposure and multi-styles” for brand customers. Brand Express supports user orientation, priority exposure in the feed ads, through the display of a variety of advertising styles, the brand owner’s promotion information can be displayed in front of the target audience in a richer and more three-dimensional manner.

Brand ads: Video Type

Short video page with banner ads

Video page with product link: Product links are integrated into video ads in the form of pre-roll ads, etc.

Weibo live-streaming: Attract users through the influence of celebrities & KOLs to achieve higher exposure

-End of the Newsletter-

Feel free to talk to us

It’s a team with one single shared goal, which is our client’s success. Deliver results for your business now.